-

FAQ on Registration

-

1. When register on the internet banking, can I reserve the phone number of others?

-

A: The phone number should be the user’s instead of that of others.

-

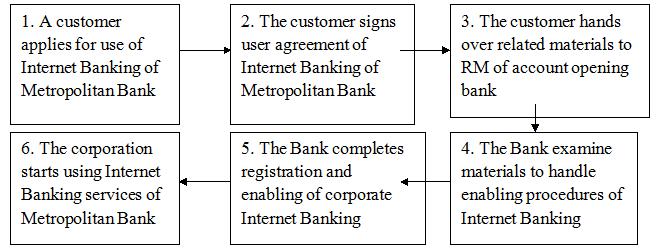

2. How to become corporate internet banking customer of Metrobank?

- A:

-

-

3. What kind of operator roles are available in Metrobank's Internet Banking?

- A: There are three operator roles in corporate Internet Banking, i.e. clerk/encoder, approver/review officer, and review/approver manager.

- The role of clerk/encoder refers to the operator responsible for preparing documents in a corporation; the role of approver/reviewer refers to the operator responsible for double checking Internet banking transactions in a corporation; the role of reviewer/approver manager refers to the operator having both the rights to prepare documents of Internet banking transactions and to double check these transactions.

- 4. Does real-name account under my name need to be verified when I handle registration of Internet banking with a counter?

- A:When you apply for the opening of Internet Banking, the ID number you fill should be same with the number you registered when opened the account.

-

FAQ on Fund-Transfer

-

1. Which accounts can make fund-transfer operation?

-

A:Accounts registered at the Bank's teller counter can make Fund Transfer operation.

-

2. What function can "Bulk Transfer" achieve?

- A: In this function, the transferor can make transfer operations to the beneficiaries in certain ranges at the same time. The transfer amount can be set to be the same or different. It also allows multiple transfer operations done with a single transaction making it very flexible.

-

3. What time can I do fund-transfer operation?

- A: The Bank's inter-bank Fund Transfer processing period is from 9:00-04:00, Monday-Friday apart from National Holidays.

- 4. What is Scheduled Fund Transfer?

- A:Scheduled Fund Transfer refers to when the corporate client appoints a transfer date allowing the system to automatically achieve single payment to other corporate accounts on that day.

-

FAQ on General Usage

-

1. Head office and branches of our company need to allocate funds between them a lot. Will your bank be able to help our company realize fast allocation of funds between head office and branches?

-

A: he Bank's corporate Internet banking can meet your company's need of managing funds in time and distance. With this function, employees of the parent company of a group can perform manual collection of funds to a signed sub-account, manual allocation of funds to a signed sub-account, setting automatic collection and allocation of funds to a signed sub-account, etc. Furthermore, employees of the parent company of the group can view balance and other information of the signed sub-account with this function, improving efficiency of the Fund Transfer operations of the company and saving management cost to the maximum extent.

-

2. How long will it take before Internet Banking logs out automatically once it is idle?

- A:If the customer has not performed any operation to Internet Banking system webpage for 10 minutes after logging in, Internet Banking will log out automatically.

-

3. What is the introduction to account alias setting of a corporation?

- A: After setting alias of a listed account, users can conveniently and intuitively manage his/her accounts with the alias. Only operators having access to this operation in the corporation can set and maintain aliases of the corporation's accounts.

- 4. What information can be modified by an operator in a corporation when he/she logs in?

- A:In order to ensure security of corporate information, during information modification in Internet Banking only application to modify corporate address and zip code is allowed to be submitted. It will only take effect after the application is examined and approved by operation personnel of the Bank. Modification of other information should be handled in the counter with necessary documents presented.

-

FAQ on corporate certificate

-

1. What to do if I forget my USBKEY password?

-

A: If you forgot your security tool USBKEY password, please go to the counter to report loss and change of USBKEY and bring your valid ID copy along with your corporate chop signed by the applicant and chopped by the legal person (authorized agent), and USBKEY .

-

2. How to change USBKEY password?

- A: If you need to change USBKEY password, you can change it in USBKEY management tool.

-

3. What to do if your USBKEY is broken?

- A: If USBKEY of the customer is broken, to guarantee safety of your information, the Bank will no longer provide any certificate maintenance. The client will need to go to the counter where you opened your bank account bringing their valid ID copy with their corporate chop, signed by the applicant and chopped by the legal person (authorized agent), and USBKEY .

- 4. What to do if I lose USBKEY?

- A: If you lost your USBKEY, you should go to the counter where you opened account with valid ID copy with your corporate chop, the applicant signed and chopped by the legal person (authorized agent), and USBKEY.

- 5. What to do if I input the wrong USBKEY pin several times and USBKEY got locked?

- A: If you input the wrong pin for 9 times consistently, your USBKEY will be locked and you have to go to account opening counter to apply for another USBKEY if you need continue to use it.

- 6. What to do if my certificate is about to be due or already overdue?

- A: You could process your certificate updating in advance. Please go to the account opening counter to process your certificate updating procedures with the same valid ID that you used for opening account and the original USBKEY, you will get a new USBKEY with written certificates on site.

|